Paradigm Accuses SEC Of Rule Bypass

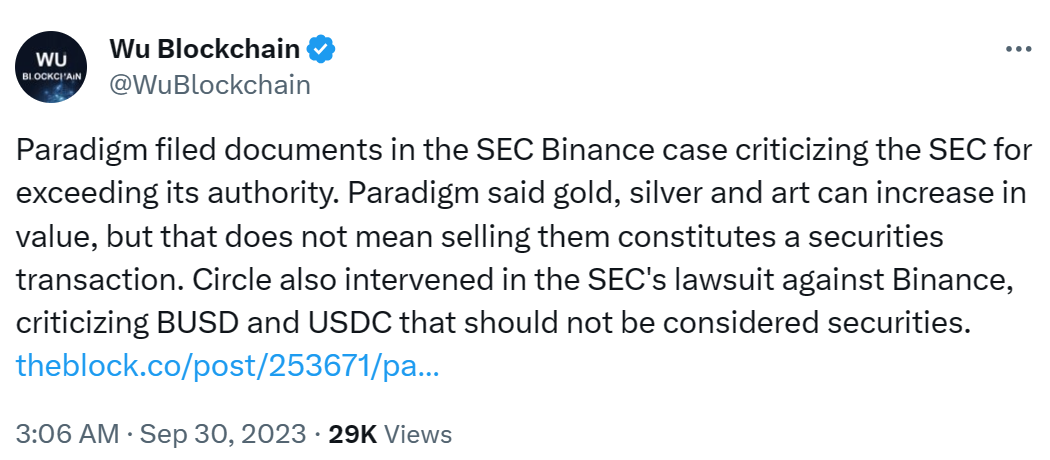

In a significant development in the ongoing legal battle between the Securities and Exchange Commission (SEC) and cryptocurrency exchange Binance, crypto venture capital firm Paradigm has accused the SEC of attempting to subvert the established rulemaking process. Paradigm’s allegations, outlined in a recent brief, shed light on the broader implications of the SEC’s actions in its lawsuit against Binance.

Binance’s Securities Violation

The SEC initiated legal proceedings against Binance in June, citing multiple alleged violations of securities laws, including Binance’s failure to register as an exchange, broker-dealer, or clearing agency. Paradigm, however, argues that the SEC is overreaching its authority by using these allegations as a means to alter existing laws without adhering to the traditional rulemaking process.

In a statement released last Friday, Paradigm stated, “Here, the SEC is attempting to leverage the disturbing allegations it levies in its complaint to change the law while circumventing the rulemaking process. The SEC is plainly acting outside the scope of its authority, and we oppose this gambit.” Paradigm’s assertion highlights the broader implications of the SEC’s actions against Binance. The agency has recently brought forth numerous cases against cryptocurrency exchanges, raising concerns about the potential impact on the crypto industry and securities laws as a whole.

Howey Test Complexity in SEC Crypto Case

One key aspect of the dispute centers on the Howey Test, a legal framework established by a 1946 U.S. Supreme Court case involving citrus groves. The SEC often uses this test to determine whether certain transactions qualify as investment contracts, thus subjecting them to securities laws. Paradigm emphasized in its amicus brief that various assets, such as gold, silver, and fine art, are traded for potential profit but have not been classified as securities. This highlights the complex nature of defining cryptocurrencies and tokens as securities solely based on their profit potential.

Read More: Chainlink Faces Scrutiny Over Wallet Changes

Circle, the company responsible for the stablecoin USDC, also weighed in on the SEC’s case against Binance, drawing attention to the broader implications for the digital currency landscape and the U.S. economy. Binance operates its own stablecoin, known as Binance USD (BUSD). In its brief, Circle stated, “The SEC’s claim that Binance offered and sold its competing stablecoin as an unregistered security raises serious legal questions affecting digital currency and the U.S. economy more broadly.”