Chainlink Faces Scrutiny Over Wallet Changes

Chainlink, the decentralized oracle network renowned for its critical role in blockchain applications, is facing intense scrutiny over recent modifications to its multi-signature (multisig) wallet security measures. These alterations have ignited a wave of concern within the cryptocurrency community, with some users questioning the company’s intentions and transparency.

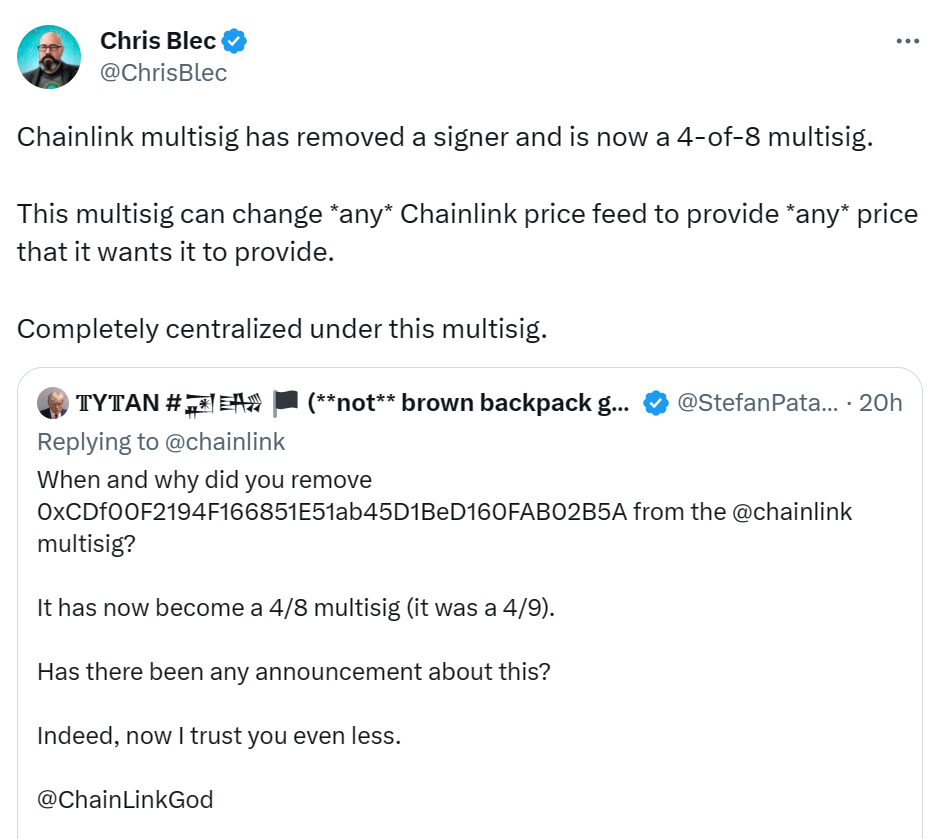

Chris Blec’s Concerns on Chainlink

Chris Blec, a prominent crypto researcher, was one of the individuals who expressed their reservations on the social media platform X (formerly Twitter). Blec shed light on the fact that Chainlink had discreetly adjusted the required number of signatures for its multisig wallet. The change shifted it from a 4-of-9 configuration to a 4-of-8 setup, where at least four out of eight authorized signers must validate a transaction.

A notable point of contention voiced by Blec was the absence of any formal communication from Chainlink regarding this significant alteration. In a post on September 24th, Blec shared a message from an anonymous user who disclosed that a wallet address had been quietly removed from Chainlink’s multisig wallet, raising further questions about transparency. Another layer was added to the ongoing discussion when an anonymous user on X speculated that Chainlink’s lack of transparency might be a strategic manoeuvre to evade potential regulatory issues with the Securities and Exchange Commission (SEC). This conjecture added fuel to the ongoing debate.

Chainlink’s Signer Rotation

Responding to the mounting concerns within the cryptocurrency community, a Chainlink community ambassador took to X to provide clarity on the situation. According to the ambassador, this change was part of their routine signer rotation process, designed to ensure the continued reliability of Chainlink services. Chris Blec, a consistent critic of Chainlink, had previously cautioned about the potential risks that the entire decentralized finance (DeFi) ecosystem might face if Chainlink’s signers were to engage in malicious activities. Blec contends that the centralization risk within Chainlink could also impact other major DeFi projects, such as Aave and MakerDAO, both of which rely heavily on Chainlink’s oracles to obtain precise price data.

Read More: Bank Of Spain Approves Coinbase

Chainlink plays a pivotal role in enabling Ethereum-based smart contracts to securely interact with real-world data and services, effectively bridging the gap between blockchain networks and the external world. Despite the recent controversy, Chainlink’s native LINK token has exhibited resilience in the market. According to data from CoinMarketCap, the token has seen an almost 20% increase in value over the past month, with a current trading price of $7.27, reflecting an 8.51% gain in its value over the previous week.