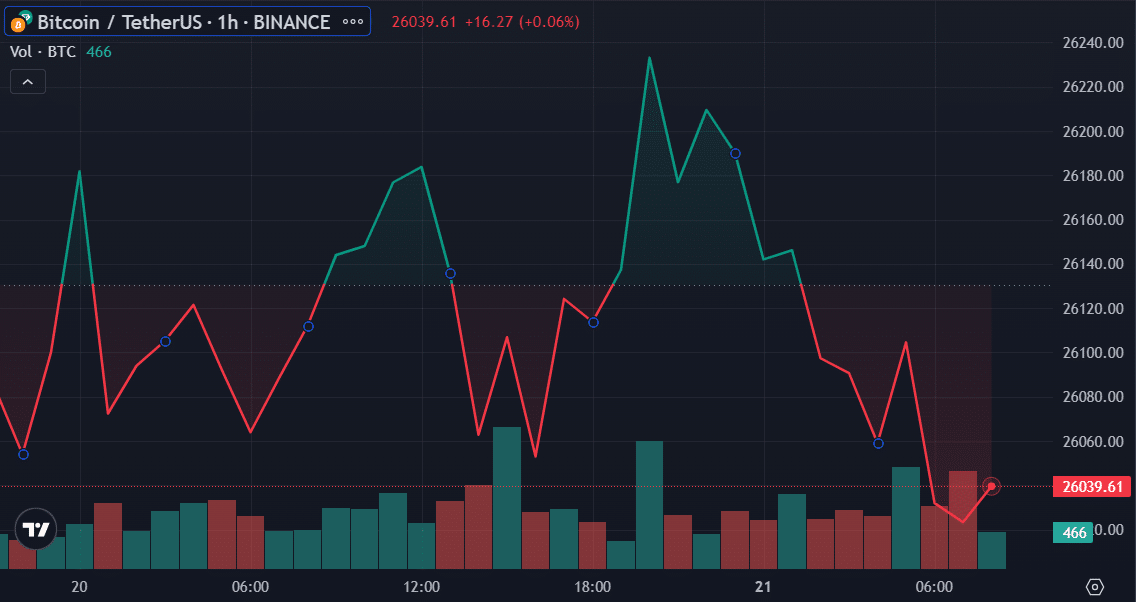

BTC Struggles At $26K After SpaceX Sale

The price of Bitcoin (BTC) continues to grapple with resistance around $26,000 following an announcement that Elon Musk’s space exploration company, SpaceX, has offloaded its Bitcoin holdings. This move by SpaceX has added to the ongoing market uncertainty.

Bitcoin is still struggling around the $26k mark despite the rising number of holdershttps://t.co/qS9F0453QW

— crypto.news (@itscrypto_news) August 21, 2023

BTC Wallets at ATH

In contrast to the prevailing bearish sentiment, on-chain analytics provided by Glassnode indicate a remarkable trend: the number of wallets holding at least 1 BTC has surged to an all-time high (ATH) of 1,015,299. This data is particularly noteworthy, considering the broader market challenges. These wallet numbers have been on an upward trajectory since late 2021, coinciding with Bitcoin’s historic all-time high of $68,790. Despite the recent price downturn, individual investors appear to be continuing to accumulate Bitcoin, a behaviour that could suggest a prevailing long-term bullish sentiment in the market.

📈 #Bitcoin $BTC Number of Addresses Holding 1+ Coins just reached an ATH of 1,015,299

Previous ATH of 1,015,241 was observed on 20 August 2023

View metric:https://t.co/s7tx1xxyz3 pic.twitter.com/DsYGzzLEhV

— glassnode alerts (@glassnodealerts) August 21, 2023

However, the recent selloff and Musk’s influence seem to have had an impact on short-term traders as well. Glassnode data indicates that BTC supply active within a one-week to one-month time frame has dropped to 680,353.028 BTC, marking a 30-day low. This could be a sign that some short-term traders are adjusting their positions in response to the recent market volatility.

📉 #Bitcoin $BTC Amount of Supply Last Active 1w-1m (1d MA) just reached a 1-month low of 680,353.028 BTC

View metric:https://t.co/daWGzpwg77 pic.twitter.com/gJ8VYNBGmn

— glassnode alerts (@glassnodealerts) August 21, 2023

SpaceX Liquidation Impact

SpaceX’s decision to liquidate its BTC holdings contributed to an environment of heightened market activity. The aerospace company had accumulated approximately $373 million worth of Bitcoin during 2021 and 2022. Following this announcement, the crypto market saw a surge in liquidations, exceeding $1 billion. The majority of these liquidations, around 83%, were associated with long positions.

Read More: North Korean Hackers Steal $200M In 2023

As of the time of writing, Bitcoin remains down by 0.3% over the past 24 hours, trading at $25,990. The 24-hour trading volume for BTC has also dipped by 2.5% and stands at $9.4 billion. Despite these fluctuations, Bitcoin touched a 24-hour high of $26,260 on August 20. Bitcoin’s market capitalization continues to remain above the $500 billion threshold, asserting its dominance in the market with a 48% market share. As the cryptocurrency landscape navigates Musk’s influence and evolving market dynamics, traders and investors are closely observing the interplay between market sentiment, institutional actions, and individual investors’ strategies.