Valkyrie Pauses Ethereum Futures Amid SEC

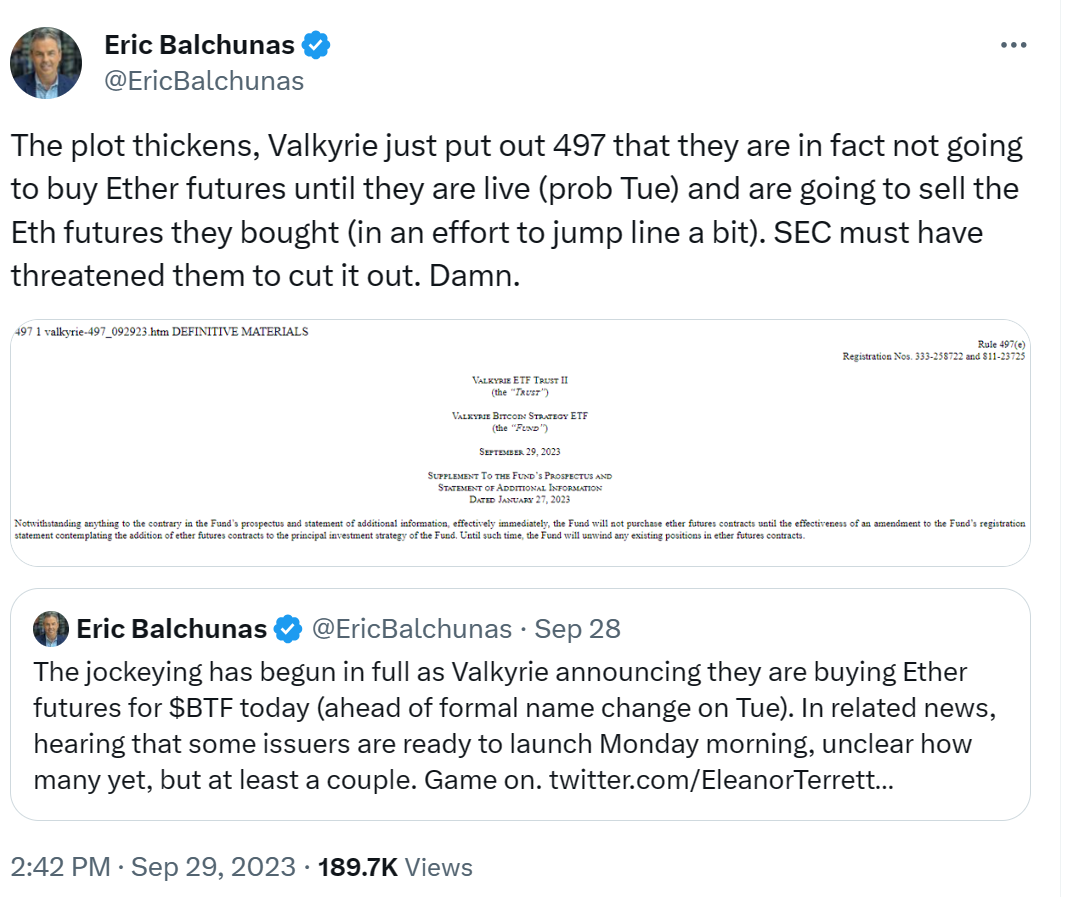

Valkyrie, the trailblazing firm responsible for the Valkyrie Bitcoin Strategy exchange-traded fund (ETF), has taken an unexpected turn by announcing a temporary halt to its acquisition of Ethereum futures contracts. This decision, revealed through a 497 filing, has raised speculation regarding the influence of the United States Securities and Exchange Commission (SEC) on Valkyrie’s strategic choices.

Valkyrie’s Ethereum ETF

The Valkyrie Bitcoin Strategy ETF made headlines by becoming the first American ETF to provide investors with exposure to both Ethereum and Bitcoin futures within a single investment vehicle. This move was seen as a significant stride in bringing mainstream recognition to Ethereum, the world’s second-largest cryptocurrency.

Moreover, Valkyrie solidified its position as an industry leader when it secured approval for an Ethereum futures ETF, allowing investors to access this innovative asset class. This approval necessitated an update to the firm’s prospectus and risk disclosures, reflecting the inclusion of Ethereum. Eric Balchunas, a senior ETF analyst at Bloomberg, has suggested that Valkyrie’s decision to halt Ethereum futures purchases might be influenced by the SEC. The exact extent of the SEC’s involvement remains unclear, but it has ignited discussions about the regulatory landscape surrounding cryptocurrency ETFs.

Crypto ETF Battle

Valkyrie’s move comes at a time when competition is intensifying in the cryptocurrency ETF sector. James Seyffart, a Bloomberg Intelligence analyst, pointed out that Bitwise has filed for a pure Ethereum ETF with the ticker AETH, featuring a 0.85% fee and an expected launch date set for the upcoming Monday.

Read More: Bank Of Spain Approves Coinbase

Amid these developments, Valkyrie has chosen to temporarily refrain from further acquisitions of Ethereum futures, opting instead to sell some of the contracts it had previously procured. The company has articulated that this strategic decision is aimed at gaining a favorable position in the competitive landscape.