UAE Imposes $2.7M Fine On OPNX

The Dubai Virtual Assets Regulatory Authority (VARA) has intensified its actions against the cryptocurrency exchange Open Technology Markets Ltd. (OPNX), marking a significant development in the regulatory landscape of the United Arab Emirates (UAE). This move comes as a response to alleged violations and bankruptcy claims surrounding the exchange.

OPNX has been fined $2.7 million by the Dubai Virtual Assets Regulatory Authority (VARA)https://t.co/Fvg7j5CSvt

— crypto.news (@itscrypto_news) August 16, 2023

VARA’s Regulatory Vigilance

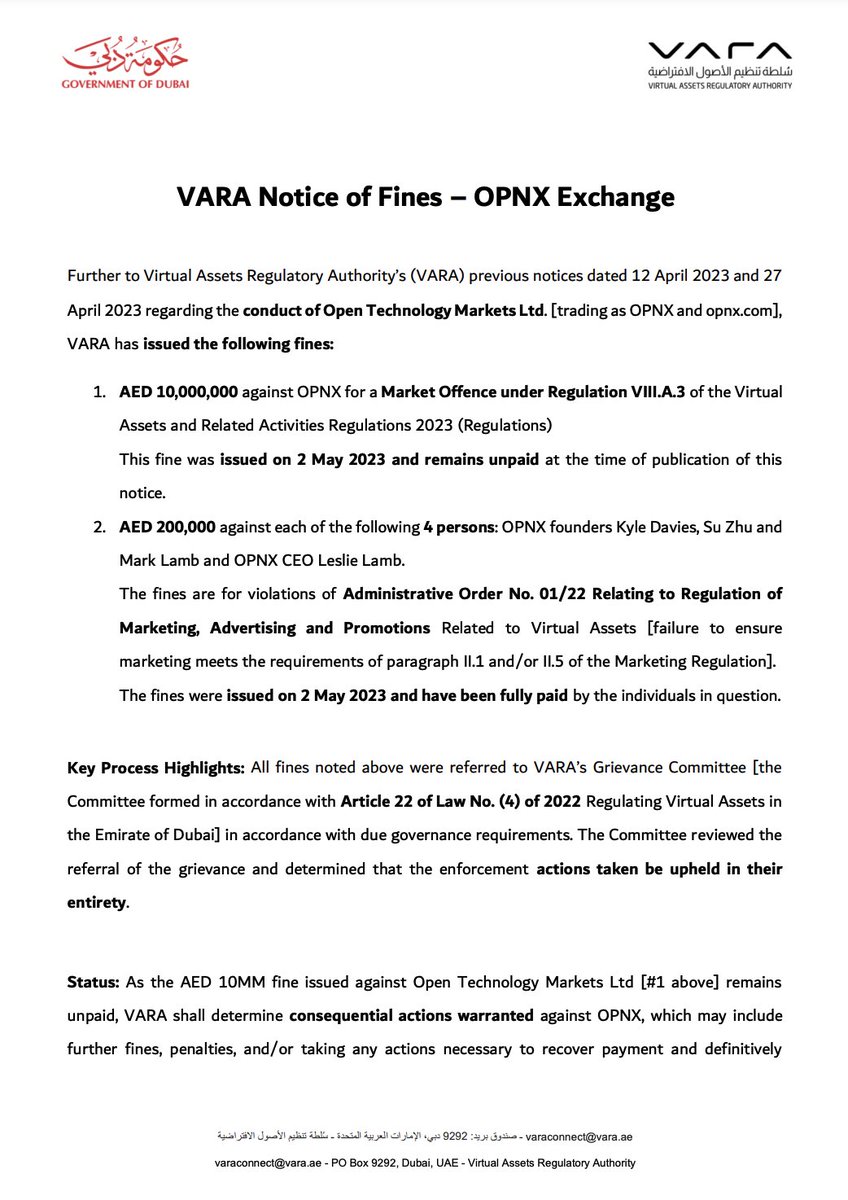

The latest actions build upon previous notices issued in April 2023, which highlighted concerns about OPNX’s conduct. In addition to these notices, VARA has imposed fines on both the exchange and its executives, underscoring the regulator’s commitment to maintaining a compliant crypto ecosystem.

The recent regulatory actions are rooted in a May 2 fine of $2.7 million that OPNX incurred for violating Dubai’s Virtual Assets and Related Activities regulations related to marketing and promotion. Despite the issuance of the fine, OPNX has yet to make the payment. The VARA intervention is also triggered by claims of bankruptcy against the exchange. VARA’s enforcement actions are meticulously reviewed by its Grievance Committee, a process that adheres to legal guidelines. The Committee’s endorsement of the enforcement actions against OPNX lends legitimacy to the fines that have been imposed.

Compliance Pursuit

Given OPNX’s failure to pay the fine, VARA is actively contemplating further measures to ensure compliance. These actions could encompass additional fines, penalties, and, if necessary, engagement with law enforcement or legal channels. Dubai has emerged as a prominent technology hub in recent years, attracting major crypto exchanges such as Kraken, Binance, and Bybit, which have established offices in the city. This trend is expected to continue as Dubai solidifies its position in the technology and finance sectors.

Related: Dubai AI Campus Introduces Scaling Tech Licenses

In May 2023, VARA issued a warning to Bybit, a crypto exchange, stating that compliance with UAE’s laws would be mandatory if a license were to be granted. The move reflects the regulator’s commitment to upholding robust standards across the cryptocurrency landscape.