Tezos (XTZ) Price Prediction 2023-2030, $10-$50

Tezos (XTZ) Price Prediction 2023-2030, $10-$50

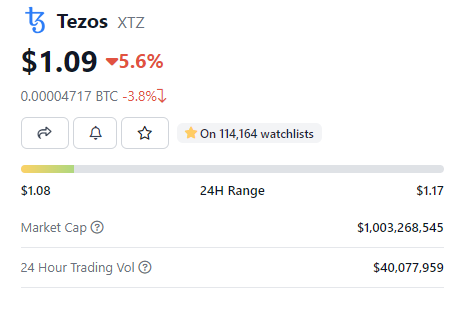

Tezos (XTZ) Current Price $1.10 (89.51 INR)

XTZ Price Statistics

Tezos price: $1.10 (89.51 INR)

Tezos Rank: 52

XTZ Market Cap: $1,005,333,461 (81,919,087,949 INR)

Tezos Volume: $43,261,037 (3,525,742,183 INR)

All-Time High: $9.12 (676.89 INR)

All-Time Low: $0.350476 (24.73 INR)

What Is Tezos (XTZ)?

Tezos (XTZ) is known as a blockchain-based platform for smart contracts, cryptocurrency, and decentralized applications. Since it was launched back in 2018, Tezos has grasped a lot of attention across the crypto community. The Swiss-based Tezos was founded in 2014 by Kathleen and Arther Breitman. Nearly 3 years after that, the Tezos Foundation remained successful in gathering up to $232M via an initial coin offering (or ICO) that ran for only 2 weeks.

The platform accepted donations made in both Ethereum and Bitcoin. Approximately a year following the accomplishment of the ICO, the beta version of Tezos was launched on the 30th of 2018’s June. Keeping in view the vulnerabilities, it was intended that the beta net of Tezos would operate till it gets stable and the platform implements patches for the respective vulnerabilities. In 2018’s September, the firm finally carried out the formal mainnet launch. The token supply of the token had been above the $1 billion mark.

Innovation on Tezos

At present, a large sum of blockchain platforms is available in the world of cryptocurrency. The status of Tezos among them is distinct as the platform keeps on making the latest developments. It pays considerable attention to formal verification as well as its utilization of a consensus algorithm based on proof-of-stake. The platform of Tezos is considered to be a self-correcting crypto-ledger.

Its protocol, which is responsible for the validation as well as the implementation of the consensus algorithm, can correct itself. Because of its unique system, it additionally carried out passive upgrades with decentralization. Each of the updates on the protocol experiences diverse testing cycles. The community of the protocol additionally offers relevant input over this. This indicates that whatever development takes place is authorized by the community of Tezos. In this way, there is no chance for the split of a hard fork into the community.

Trending Now: Aptos (APT) Price Prediction 2023-2030, $100-$500

The company uses resilient technology in terms of programming languages to numerically guarantee the accuracy of the implementation as well as to prevent future vulnerabilities or runtime attacks. The programming languages that Tezos utilize fall under the category of operational programming languages. For instance, OCaml is the programming language in which the codebase is written. The systems dealing with memory management prevent several usual runtime errors. These errors include buffer overflows or null point omissions.

On the contrary, the platform additionally utilizes a smart contract language called Michelson. The respective language has been distinctively structured to assist in the verifiability and readability of the contracts. Along with this, the respective language is even substantially low to fulfill the performance predictability that is required for on-chain execution.

Proof-of-Stake Consensus of Tezos Versus Proof-of-Work

The present protocol of Tezos is based on a Liquid Proof-of-Stake algorithm. Proof-of-stake is considerably different from the proof-of-work consensus mechanism. It deals with staking where the consumers (holding the tokens) are categorized as the main resource utilized to construct the block pool. They are named bakers on the Tezos protocol. The platform arbitrarily selects the bakers.

To get included in the respective random selection, nearly 10,000 tokens must be held by the bakers. In this respect, the participants who have fewer tokens or would not take part in baking blocks have another option. They can delegate the tokens in their possession to some other baker. The respective voting rights delegation is categorized as Liquid Democracy.

On the Contrary, the proof-of-work consensus mechanism is most broadly utilized in blockchain technology. Bitcoin is a prominent example in this respect. Nevertheless, the respective mechanism utilizes a huge amount of computing resources to carry out mining. Thus, it is considered inefficient, unsustainable, and expensive.

Tezos (XTZ) Price Prediction 2025-2030

In 2025, Tezos (XTZ) is expected to reach the $3.50 (285.34 INR) mark.

In the next year of 2026, the anticipated statistics indicate that the XTZ token could reach a price of up to $4.75 (387.25 INR).

The Price of Tezos could touch the $5.15 (419.90 INR) spot in the year 2027.

After that, in 2028, the peak price of Tezos could be $5.85 (476.97 INR) while $5.25 (428.06 INR) could be its lowest price. Thus, $5.55 (452.66 INR) will be the XTZ token’s average price in 2028.

The year 2029 might witness Tezos trading between $6.00 (489.23 INR) and $7.00 (570.77 INR). Thus, $6.50 (530.00 INR) could be its average price in 2029.

In 2030, Tezos’ average price could be nearly $7.50 (611.60 INR) while $8.00 (652.47 INR) and $7.00 (570.83 INR) could be its highest and lowest price levels respectively.

FAQs

Where to Purchase Tezos?

Tezos (XTZ) is traded on several centralized exchanges. Bitforex is a prominent exchange in this respect. It is considered the most active platform for the XTZ/BTC trading pair. The trading volume of Bitforex is nearly $639,432 (52,081,744 INR) in the previous 24 hours. Some other famous options take into account Coinbase and BingX.

What Is Today’s Market Sentiment for Tezos?

The community is currently bullish on the price performance of Tezos as above 90% of consumers consider the XTZ token to be good today.

How Does Tezos’ Price Performance Compare Against Its Rivals?

In the previous seven days, the price of Tezos has witnessed a downturn by nearly -0.30%. the token is underperforming in the worldwide market of crypto assets. The overall crypto market is currently up by nearly 1.48%.

What Is Unique in Tezos?

Tezos utilizes a power-efficient algorithm. Dissimilar to the proof-of-work-based blockchains such as Bitcoin, the proof-of-stake mechanism of Tezos requires considerably decreased cost and power to operate. This makes the platform the finest substitute for constructing blockchain apps that are friendly to the environment.

How Does Tezos Outperform Ethereum?

The platform of Ethereum is known as a good choice in the case of immutability and decentralization. When it comes to developing an app that cannot be closed, the developers prefer the platform of Ethereum. However, so far the scalability as well as the rapid transfer speeds are concerned, Tezos is considered a better choice for developers.

Who Are the Rivals of Tezos?

There are a lot of platforms that compete with Tezos. Some prominent among them take into account HYPR, Zerohub, HolllaEx, BitFury, Mastercard Blockchain, BlockCypher, Hyperledger, and Metamask.

How Secure Is Tezos?

Keeping in view that several of the well-known crypto exchanges have listed Tezos, it is convenient for investors to trade as well as purchase the token in a secure manner. Apart from that, the Tezos investors have the option to stake the tokens either straightly on the network of Tezos or through a wallet or exchange. In return for their staking, the investors can earn interest.