Rashawn Russell To Plead Guilty In Crypto Scam

Rashawn Russell, a former investment banking professional who previously worked at Deutsche Bank, is poised to admit his involvement in cryptocurrency fraud, following a series of court proceedings. The case took a significant turn when Russell, who had initially pleaded not guilty, recently signalled his intention to enter a guilty plea.

Russell’s Legal Manoeuvres

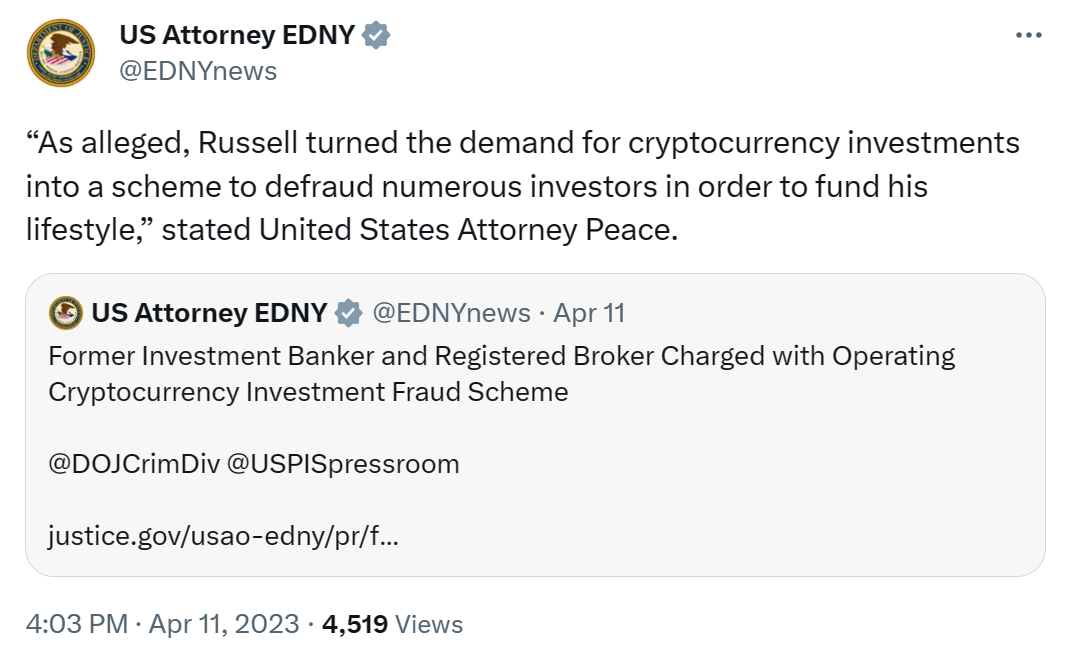

Federal prosecutors had previously charged Russell with cryptocurrency fraud, alleging that he had misled investors by making false promises of “assured profits.” The case’s evolution saw multiple delays as plea discussions unfolded between Russell’s legal team and federal authorities. Consequently, the matter was transferred to a magistrate judge to facilitate a “guilty plea hearing,” as detailed in recent court records.

Prosecutors assert that Russell deceived his clients regarding the use of their invested funds. He had allegedly guaranteed investors substantial returns, exceeding 100%, through crypto investments. However, it is alleged that he fabricated documentation to create a false impression of significant liquidity. Federal authorities claim that a significant portion of the funds collected by Russell from investors was diverted towards personal expenditures, including gambling, and servicing previous investors.

Deutsche Bank Clear of Wrongdoing

Importantly, Deutsche Bank has not been implicated in any wrongdoing associated with this case. The financial institution has affirmed its complete cooperation with law enforcement agencies throughout the investigation. In addition to the federal charges, Russell also faces legal challenges from the Commodity Futures Trading Commission (CFTC). The CFTC accuses him of defrauding investors via the “R3 Crypto Fund,” alleging the misappropriation of approximately $1 million between November 2020 and July 2022.

Read More: North Korean-Russia Cyber Alliance

The road to trial for Russell has not been without controversy. In June, he faced allegations of violating his bond conditions by frequenting gambling establishments and obtaining credit cards under assumed names. Following these accusations, a federal magistrate ordered electronic monitoring of Russell and instructed authorities to monitor his online activities.