Hedera (HBAR) Price Prediction 2023-2030

Hedera (HBAR) Current Price $0.061137 (5.02 INR)

HBAR Price Statistics

| Hedera (HBAR) Price: | $0.061137 (5.02 INR) |

| Hedera (HBAR) Rank: | 34 |

| Hedera (HBAR) Market Cap: | $1,904,368,794 (156,236,034,573.23 INR) |

| Hedera (HBAR) Trading Volume: | $23,250,117 (1,907,459,361.28 INR) |

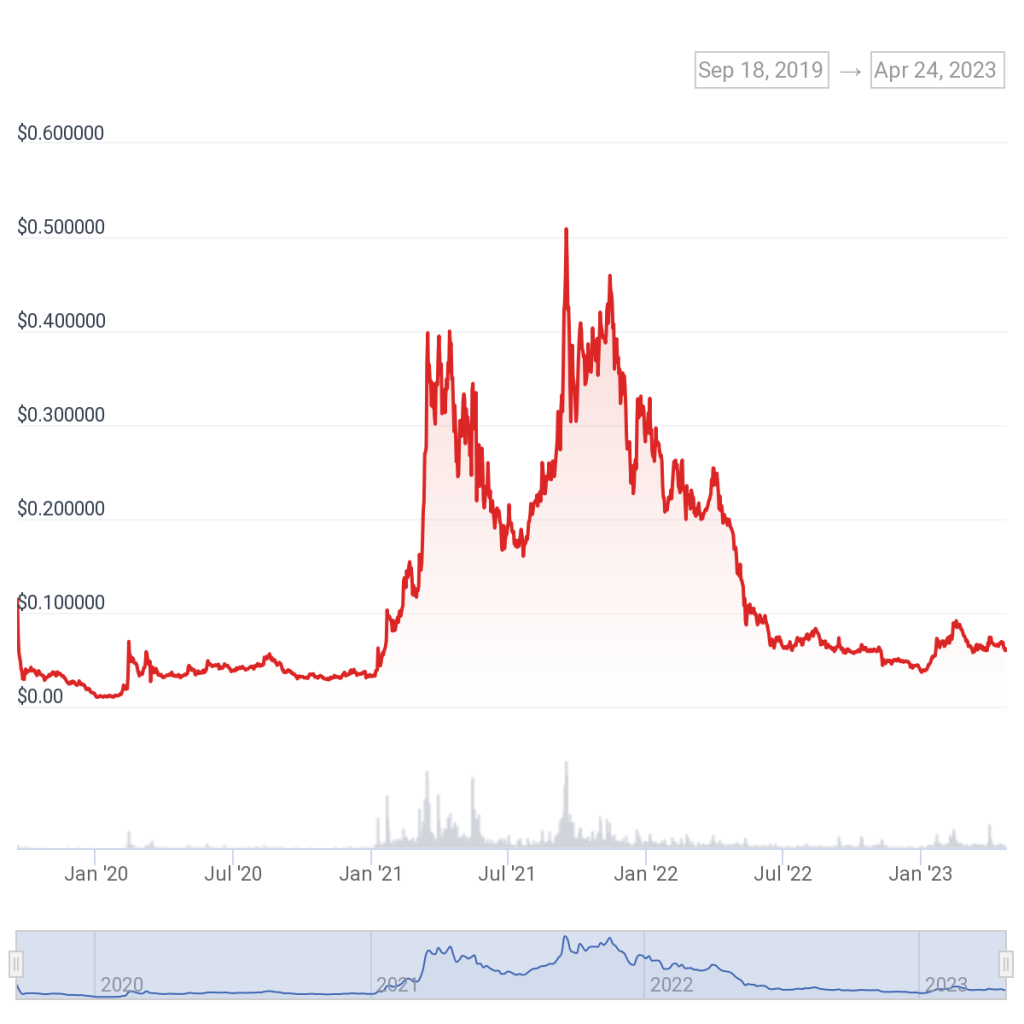

| Hedera (HBAR) All-Time High: | $0.569229 (46.70 INR) |

| Hedera (HBAR) All-Time Low: | $0.00986111 (0.81 INR) |

What Is Hedera Hashgraph?

Hedera Hashgraph is known as a crypto network pursuing to enable transactions and deployment of applications for everyone. Nonetheless, it attempts to offer a platform where a business group administers the software. In this respect, it makes noteworthy design trade-offs that make it distinct from the rest of the platforms. The network is compatible with high-speed transfers with its native cryptocurrency HBAR. However, it permits just authorized nodes to take part in defining transfer history.

A computer scientist named Leemon Baird and a technology executive called Mance Harmon are credited for the development of Hedera Hashgraph. In a mutual collaboration, they established a firm entitled Swirlds back in 2015. The respective platform created Hedera Hashgraph for the development as well as the governance of a live network Hedera with the use of its technology. HBAR Hashgraph, since 2018, has collected $124M by selling its HBAR token via a simple agreement for future tokens offering (SAFT).

Trending Now: Ethereum Price Analysis September Week 1

The most exclusive feature of Hedera Hashgraph is that “hashgraph” (the platform’s data structure dealing with grouping transfers) asserts to process additional transfers more cost-effectively in comparison with the present blockchain platforms. Hedera Hashgraph utilizes the consensus mechanism called Hashgraph that is run by 2 node types. Consensus nodes are responsible for determining the transfer history and ordering while mirror nodes are devoted to relaying the respective information to the rest of the stakeholders within the network.

With the use of a restricted sum of nodes for the determination of the history, the platform’s Hedera model guarantees that the transfers won’t be undone later on. This is different from the consensus achievement of the rest of the conventional blockchains. On the other blockchains, the consumers determine the blockchain’s state by proposing the blocks that would be incorporated into the chain.

In this way, Hedera Hashgraph asserts to offer features taking into account a combination of benefits provided by both the private and public blockchain networks. The governance of Hashgraph is the responsibility of a body named the Hedera Governing Council. It operates the consensus nodes devoted to regulating transfer orders. Back in 2020, there were thirty-nine members in the council in total. These took into account Boeing, IBM, and Google. Recently, Dell has also become a part of the respective council.

The role of the council is to administer the software, guarantee the correct allocation of funds, vote on modifications, as well as safeguard the legal status of the network in diverse jurisdictions. Each among the members of the council can have nearly 2 consecutive maximum terms with each comprising 3 years. During the respective time, the participants have equal voting rights on the decisions related to the platform and the network.

Hedera (HBAR) Price Prediction 2023-2030

Blockchain technology and the cryptocurrency market have been getting more and more traction around the globe in recent times. The exclusive developments in distributed ledger technology and the decentralized finance (DeFi) sector have played a significant role in all this. Exclusive projects like HBAR, with improved smart contracts and tokenomics, have got more and more attention.

Market analysis of crypto assets says that the competition within the industry has increased to a great extent. In addition to the enhanced regulation, the industry partnerships, scalability, governance model, use cases, security, and community involvement have also elevated considerably. Additionally, the spike in the adoption rate, market capitalization, and developer ecosystem points toward future developments in the coming years.

Price volatility trends of the HBAR cryptocurrency indicate that the token has volatility of up to 5.64%. Fundamental analysis indicators say that the token has declined by up to -89.27% from its all-time high. Technical analysis strategies bring to the front that the overall sentiment about Hedera is bearish.

Hedera (HBAR) Price Prediction for 2023

Forecasting models for cryptocurrency specify that the maximum price of HBAR will be $0.28 (22.97 INR) by the year 2023. Nonetheless, the competition analysis in the cryptocurrency market signifies that the price of the token can dip to a low of up to $0.055 (45.12 INR) during 2023.

Hedera (HBAR) Price Prediction for 2025

Predictive analytics models for cryptocurrency disclose that the crypto token can reach $0.59 (48.40 INR) as its maximum price by the year 2025. Nonetheless, it is also expected to decline to a low of up to $0.37 (30.36 INR) by that year.

Hedera (HBAR) Price Prediction for 2030

As per the analysis, the next years will witness a significant increase in the governance model impact on the price prediction of Hedera. In this respect, $1.41 (115.68 INR) is anticipated to be the maximum price of the token by the year 2030. Nonetheless, the crypto token is also expected to see a low price of nearly $1.19 (97.63 INR) by that year.

The above-mentioned statistics and analytics assert that HBAR has long-term investment potential in the cryptocurrency market. Keeping in view the security issues and solutions, the market capitalization forecasting for HBAR is also optimistic. Its adoption rate growth is also predicted to get a boost in the next few years.

However, investors should be prepared for the risks involved in crypto investment. They should come up with suitable risk management strategies for cryptocurrency. If someone does not have any taste for risks, the crypto investment is not for him.

FAQ

Who Are the Funders of Hedera?

The prominent players in the industry are responsible for funding Hedera Hashgraph. Tata Communications and Boeing HoriozonX Ventures are known as the most well-known among them.

What Is Unique in Hedera in Comparison with Blockchain?

Hedera Hashgraph has turned out to be fairer in comparison with the blockchain. It permits the miners to select the transaction order, postpone them, or stop them from getting into a block. Nevertheless, it utilizes a timestamp consensus which keeps people from modifying the transaction order.

Where to Purchase Hedera?

HBAR tokens are available for purchase on centralized exchanges. The prominent exchange in this respect is DigiFinex. The top trading pair of the token on the exchange is HBAR/USDT with a trading volume equaling $441,597 for the recent 24 hours. Binance and Bitrue are also other alternatives for trading HBAR.

Who Are the Rivals of Hedera?

Hedera is categorized among the top 35 crypto assets. Its famous competitors take into account Aptos, Arbitrum, TrueUSD, and Lido DAO.