dYdX Price Prediction 2025-2030, $25 Minimum

dYdX Price Prediction 2025-2030, $25 Minimum

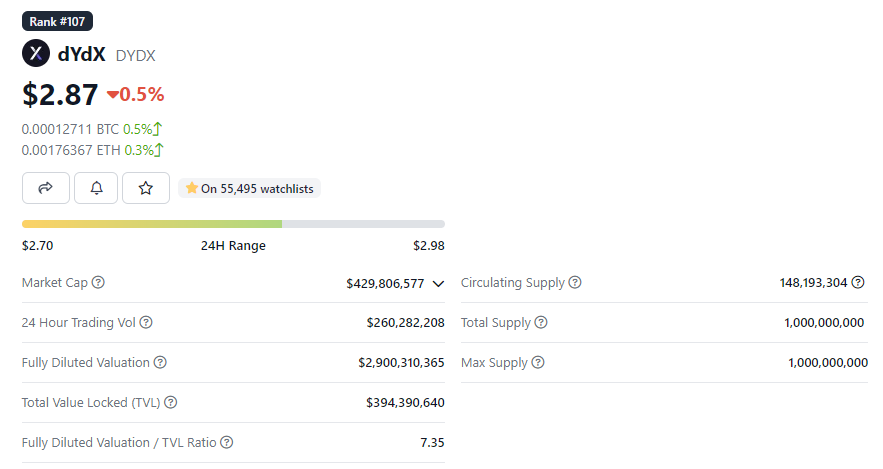

dYdX Current Price 2.90 (239.35 INR)

Price Statistics

dYdX Price: 2.90 (239.35 INR)

dYdX Rank: 107

Market Cap: $428,847,544 (35,403,515,743 INR)

Trading Volume: $258,368,616 (21,329,625,176 INR)

dYdX All-Time High: $27.86 (2,071.47 INR)

dYdX All-Time Low: $1.01 (78.79 INR)

What Is dYdX?

dYdX is known as a decentralized exchange (DEX) entity that provides perpetual trading services for more than 35 prominent crypto assets. These assets take into account Bitcoin (BTC), Cardano (ADA), Dogecoin (DOGE), and Ether (ETH) among others. The platform is categorized among the largest decentralized exchange platforms across the globe concerning market share and trading volume.

A Californian entrepreneur named Antonio Juliano established dYdX back in 2017’s August. Initially, the borrowing and lending services as well as the margin trading of crypto assets were offered via Ethereum L1. After that, the exchange company started providing perpetual cross-margin trading. The consumers, in the case of cross-margin trading, are permitted to repurpose the balance they have on the platform for the provision of liquidity to present trades. This is a well-known way to prevent liquidations when there is high volatility.

Trending Now: Why Celsius Went Bankrupt?

The development of the dYdX protocol took place on the smart contracts of Ethereum as well we the Starkware-powered STARK ZK Rollups. The protocol began its venture into the crypto world with spot trading. Since then, it has relaunched 3 iterations of the services provided by it for the decentralization of its components. The platform has provided a lot of attention to decentralization as the major proportion of the exchange platform of dYdX is established on some trustless protocols. They are openly extensible without requiring any permission.

dYdX’s Top Trading Options

dYdX is classified among the famous decentralized exchange platforms that provide L2-based perpetual trading solutions and non-fungible token collections to build community. The 4 chief products offered by dYdX take into account NFTs, staking, governance, and perpetual trading.

Perpetual Trading Offered by dYdX

The main offering of dYdX is perpetual trading and permits the consumers to utilize non-expirable contracts to trade on open markets. As a consequence of this, the investors can sell, purchase, or hold positions indefinitely till the pre-planned trading circumstances are fulfilled. For instance, if a consumer’s order is to trade 1 BTC token at $100,000, the respective order will be active till the respective price is reached by Bitcoin. At that point, the trade is accomplished. Nonetheless, an investor has the option to eliminate the contract by closing the sell or purchase order before it matures.

Staking and Governance in dYdX

Nearly 1 year following the dYdX platform’s launch, the exchange introduced its governance token “DYDX” for the protocol of dYdX. Consumers can obtain yield in the form of dYdX tokens to carry out their trading operations on the decentralized exchange. The community subsidiary of the exchange platform permits the clients to perform staking of their present crypto assets to get yield. In this respect, the in-house governance coin DYDX is used. The exchange platform provides a couple of pools. These take into account the safety pool and liquidity pool. The consumers can perform staking as well as receive rewards for contributing to the liquidity of dYdX.

dYdX’s Non-Fungible Tokens

The new product offering of dYdX comprises a collection of non-fungible tokens. Hedgies is the name of the NFT series in which there are several animated hedgehogs structured by the digital assets called Arek and Anna Kajda. Hedgies are disseminated among the consumers keeping in view the trading statistics thereof as well as the community interactions like voting.

Margin and Spot Trading on dYdX

Margin and spot trading is also offered on the platform of dYdX via the L1 blockchain protocol of Ethereum. The exchange company started these services on the 1st of November back in 2021. Since then, it has shifted to providing L2 perpetual products to advance its objective of turning into a purely decentralized exchange.

dYdX Price Prediction 2025-2030

The current price of the DYDX token is 2.90 (239.35 INR). The token saw a price slump of up to-5.389451209390279% in the previous 24 hours. In addition to this, it experienced a decline of nearly -11.627150575124947% in the recent 7 days. The circulating supply of the dYdX comprises almost 150M tokens. The former consumers of the protocol are permitted to get retroactive rewards.

The holders of the DYDX tokens can also govern the L2 protocol of dYdX which is developed with Starkware for the alignment of incentives between partners, liquidity providers, and traders. The platform has allocated a community treasury to expand its ecosystem via liquidity mining projects, grants, and other things which are determined by the governance.

dYdX Price Prediction for 2025

By the year 2025, dYdX is expected to get more popular across the decentralized finance ecosystem. In this respect, the DYDX token is anticipated to reach $10.85 (895.48 INR) in terms of price in that year.

dYdX Price Prediction for 2030

The price of the DYDX token can escalate to a great extent to reach the maximum point of nearly $24.61 (2,031.30 INR) by 2030. On the other hand, the minimum price to be reached by the token in that year will be $23.33 (1,925.65 INR). The average price of DYDX in 2030 can be $23.84 (1,967.28 INR).

FAQs

Where Can I Purchase dYdX?

Centralized exchanges of cryptocurrency offer to trade with dYdX. The well-known platform in this respect is Binance. On the top crypto exchange, DYDX/USDT is the most popular trading pair with $56,652,515 as its trading volume witnessed in the recent 24 hours. Bitget and OKX exchanges are the other entities providing trading options for the DYDX tokens.

Who Are dYdX’s Prominent Competitors?

The top industry players are the competitors of dYdX. They take into account Perpetual Protocol, GMX, and Uniswap.

Is dYdX Considered Purely Decentralized?

The platform of dYdX is majorly decentralized. Nonetheless, the firm depends on several decentralized systems in the case of the matching engine and order book.

What Are the Use Cases of the DYDX Token?

The prominent use cases of the DYDX tokens take into account participation in staking pools and getting mining rewards. The holders of the DYDX tokens can additionally utilize them to suggest modifications to the L2 of dYdX.