Costly Mistake: NFT Collector Loses 35 ETH

A collector of non-fungible tokens (NFTs) known as “Franklin” on Twitter has lost over $59,000 worth of Ethereum (ETH) due to a “fat finger” error. Franklin, who claims to be the sixth largest collector of Bored Ape Yacht Club (BAYC), mistakenly placed a bid of 35 ETH for a Beanz NFT collection, which has a floor price of less than 2 ETH. The bid was quickly accepted before he could cancel, resulting in a significant financial loss. The immutable nature of ETH and crypto transactions means that once funds are confirmed, they cannot be reversed. The only recourse for Franklin is to engage with the seller directly and convince them it was a mistaken bid. However, whether he will receive funds directly depends on the seller.

As you may already know, I placed a fat-finger collection offer of 35 ETH on Beanz. I meant to type a much lower bid with a quantity of 35, but I instead bid 35 ETH for 1 purchase (floor of like 1.73 ETH at the time). It got accepted before I could cancel.

Oops.

I’ll be okay.

— Franklin (@franklinisbored) February 19, 2023

Beanz NFT Collection

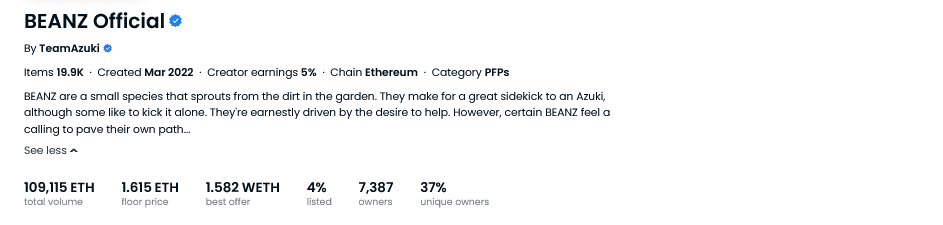

The Beanz NFTs are a collection of “small species that sprout from the dirt in the garden” and can make a “great sidekick for Azuki.” All Beanz NFTs have been minted on the Ethereum blockchain and are listed on several marketplaces, including OpenSea and Rarible. On OpenSea, only six NFTs are valued between the 30 ETH to 35 ETH range. Specifically, Bean #12645 and Bean #18478 are listed for 35 ETH. Interested buyers can place bids, and the auction for each ends in four and two months, respectively.

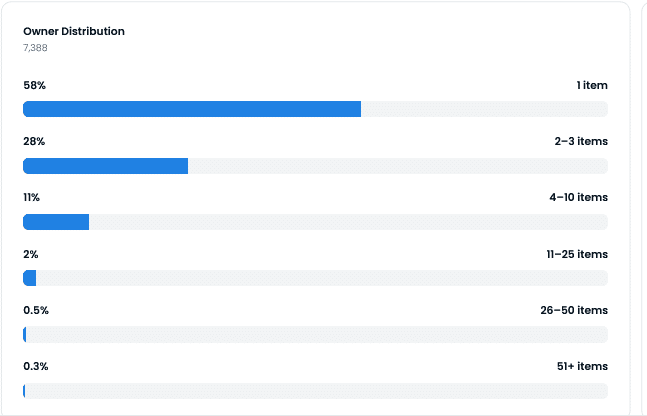

Per OpenSea statistics, there are 19.9K Beanz owned by 7,396 holders. The floor price stands at 1.615 ETH, a price that’s been steady in February. The collection has a total trading volume of over 109k ETH. The majority of Beanz holders own one NFT item, with less than one percent being holders of at least 50 NFTs.

This incident highlights the importance of carefully reviewing and double-checking bids before submitting them in the fast-paced world of NFT auctions. The immutable nature of crypto transactions means that traders must be extra cautious, as mistakes can lead to significant financial losses.