Coinbase Q4 Losses Deepen Amid Regulatory Pressure

Coinbase Global Inc., the largest US cryptocurrency exchange, is expected to report a loss of nearly $600 million in the fourth quarter of 2022, along with a plunge in revenue for a fourth consecutive quarter. This has led to increased tensions between the company’s CEO, Brian Armstrong, and US regulators.

Coinbase is forecast by analysts to report a loss of nearly $600 million in the three months that ended in December. Its staking and stablecoin revenue faced regulatory uncertainty. Bloomberg https://t.co/I6HoHz4RhU

— Wu Blockchain (@WuBlockchain) February 21, 2023

Bleak Outlook

The outlook for Coinbase’s three key businesses – coin custody, stablecoins, and staking – is also looking bleak, as all three sectors have come under increased regulatory scrutiny. Rival exchange Kraken recently entered into a settlement with the US Securities and Exchange Commission (SEC) to close its US staking business, while Paxos Trust Co. stopped issuing a Binance-branded USD stablecoin under pressure from New York regulators.

Coinbase receives about 3% of its total revenue from staking fees and also generates revenue from stablecoin USDC, which it helped create as part of a consortium, and offering coin custody services. The company has been trying to diversify to reduce its dependence on trading fees, which are susceptible to the wild price swings in the crypto market.

The uncertainty surrounding Coinbase’s key businesses and potential regulatory crackdown is already having an impact on the company’s market share, with Coinbase erasing market-share gains it made since the collapse of rival FTX exchange in November. While its share rose from 5.9% in November to 6.5% in January, it has dropped to 4.1% in February so far, according to researcher CryptoCompare. Binance remains the world’s biggest crypto platform, with a market share of about 60%.

Shares Surge Amid Crypto Rally

However, one prong of Coinbase’s strategy that could yield positive results is international expansion, particularly into countries with more favorable crypto regulations. Coinbase and other companies may be “forced to go offshore and expand operations outside of the US,” according to Owen Lau, an analyst at Oppenheimer & Co.

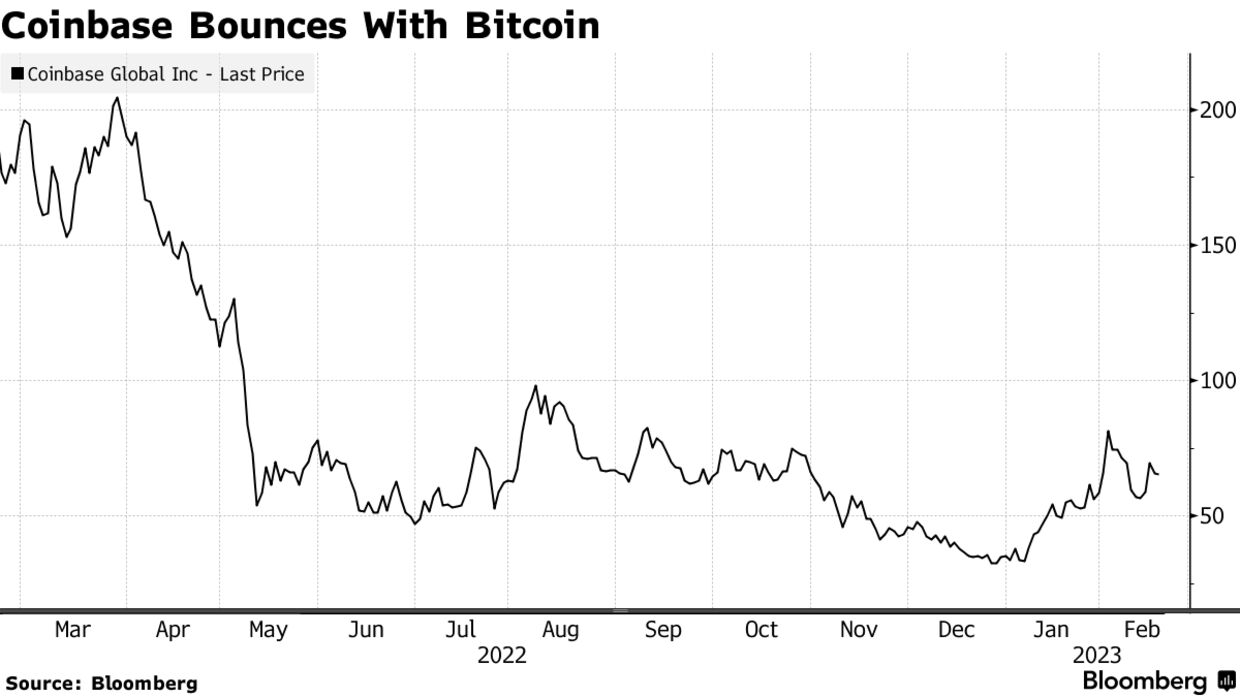

Coinbase’s shares have surged more than 80% since the beginning of the year, buoyed by the general rally in risk assets such as tech stocks and Bitcoin, the world’s biggest cryptocurrency. That’s after tumbling 85% in 2022. The stock is down about 80% from its closing record high in April 2021.

Despite the tough times for the industry, Coinbase is expected to report slightly higher revenue in the first quarter ending in March, according to Bloomberg data. Analysts polled by Bloomberg expect revenue of $594.8 million and a loss of $427 million in the period ended in March. Coinbase has said it would lose no more than $500 million in adjusted earnings before items such as taxes in 2022. Some analysts expect the company to cut expenses further.