CME Bitcoin Futures Hits Record Highs

Amidst a widespread decline in cryptocurrency trading volumes across various exchanges, CME Group has defied the odds by registering its highest monthly volumes of the year in July, according to data from The Block’s data dashboard.

CME bitcoin futures monthly volumes hit yearly high https://t.co/24kRa71izi

— The Block (@TheBlock__) July 29, 2023

CME’s Bitcoin Futures

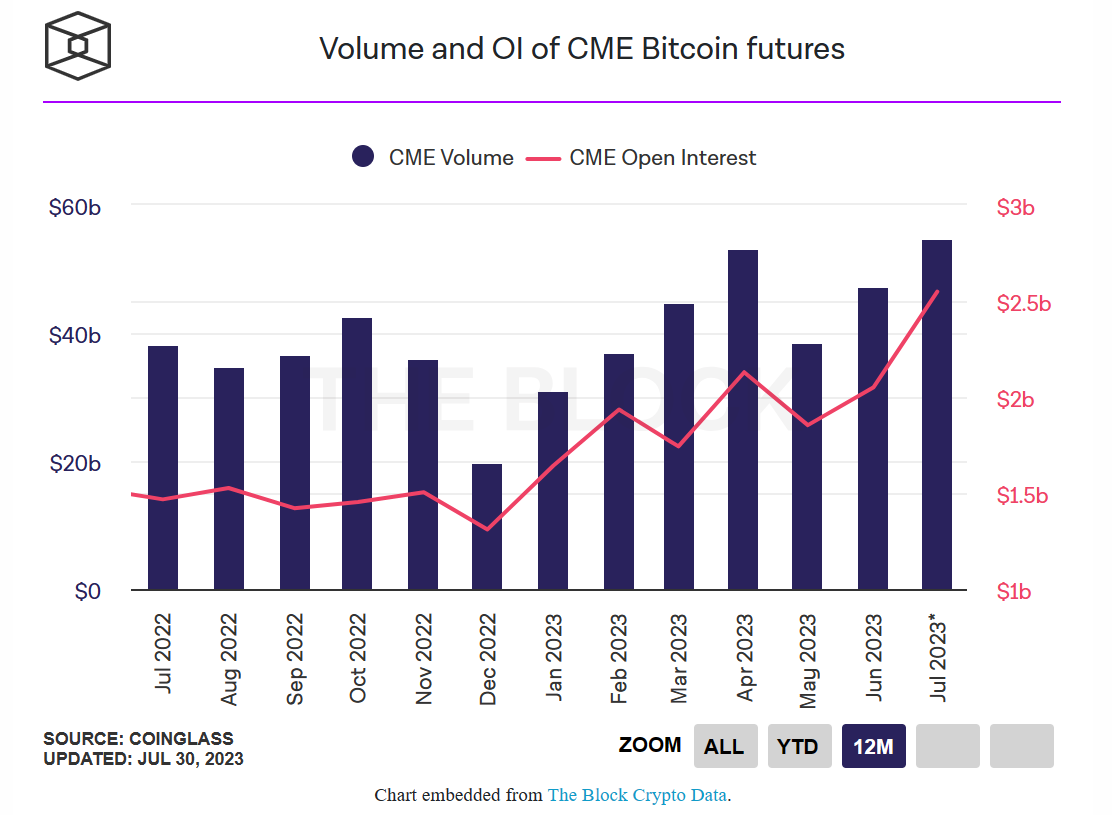

CME’s bitcoin futures market emerged as the standout performer, surpassing its previous high in April. The exchange recorded an impressive $53.33 billion in trading volumes with a day still left in the month. Comparatively, back in April, the firm witnessed $53.06 billion worth of contracts changing hands.

One key factor that sets CME apart in the crypto industry is its strong appeal to institutional investors, including hedge funds and large trading firms. While other exchanges grappled with reduced trading activity impacting their revenues, CME managed to capitalize on its bitcoin futures market, attracting significant interest from institutional players. As of July 29, open interest in the CME bitcoin futures market reached an impressive $2.5 billion. This remarkable figure highlights the sustained interest and participation of institutional investors in CME’s trading offerings, even amidst the broader downtrend in the crypto market.

Spot Trading Plummets

In contrast, spot trading volumes across the entire cryptocurrency market have taken a significant hit, reaching nearly the lowest levels of the year. The Block’s data dashboard revealed that the seven-day moving average for spot crypto trading stood at $11.1 billion. This represents a stark decline, constituting only a quarter of the volume observed when it hit a year-high above $40 billion in March.

Related:Missing Crypto Millionaire Found DismemberedWhile the broader cryptocurrency industry faces headwinds due to the declining trading activity, CME Group’s ability to achieve record-breaking volumes showcases the resiliency and attractiveness of its offerings in the eyes of institutional investors. The sustained interest and high volumes in CME’s bitcoin futures market point towards a potential shift in the dynamics of the cryptocurrency space. Institutional involvement could play a crucial role in the market’s recovery and pave the way for renewed interest and growth in the future.