Bitcoin Back on Track after Repeated Blows from Banking Sector

Bitcoin has resumed its 2023 surge and climbed above $24,000 following a seven-day drop brought on by a series of legal proceedings against significant banking actors in the market. Many other big digital currencies rose sharply today, and equities with a connection to cryptocurrencies also did so. Following a sharp decline in value caused by investor panic due to issues involving Silvergate and Silicon Valley Bank, Bitcoin appears to be making a full recovery. The Bitcoin price may have benefited from a recent declaration by US regulators that they would help clients recover stolen money.

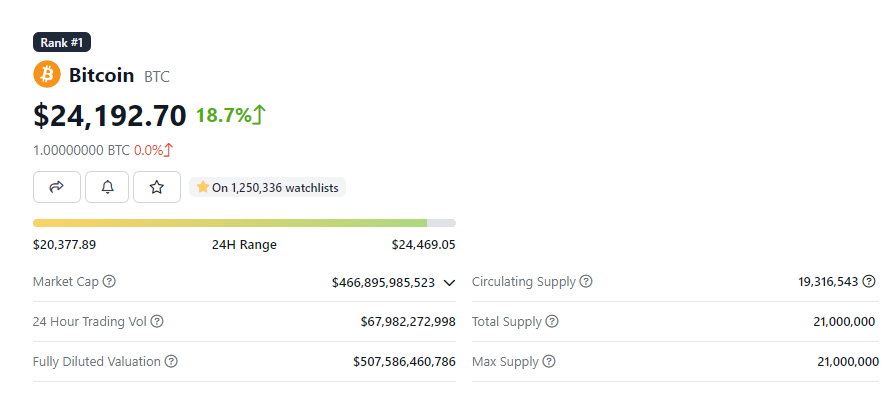

The most recent data by Coingeko shows that during the past two days and a half, its value has increased by more than 18.7%. As of the publishing date, one Bitcoin cost $24,192. Over the same time frame, BTC’s trade volume surged dramatically, reaching $67,982,272,998.

Despite Recent Watchdog Action, Circle Suggests Automated Minting for USDC

A well-known manufacturer of digital dollar crypto assets, Circle, has announced automated minting and repayment of USDC for its customers with the aid of additional financial partners. The Circle is taking this move to protect the core of its online payment and financial systems from the risks caused by fractional reserve banking. While bank contagion has a negative influence on the crypto market, Circle Chairman Jeremy Allaire has highlighted that the company would continue to guarantee the reliability, 1:1 redeemability, and security of every USDC in operation.

Trending Now: Flex Yang Introduces HOPE Ecosystem and Distributed Stablecoin

The majority of the USDC reserve, $32.4 billion, is maintained in cash at BNY Mellon, with the remaining money being collateralized by short-term US Treasury Bills. The reserves are kept by BNY Mellon, and BlackRock is in charge of managing the assets’ liquidity and management. To be open with its investors, Circle posts monthly USDC verification reports on its website.

According to Yellen, the Appropriate Regulatory Organisations Must Take the Necessary Steps

Secretary Yellen authorized the FDIC to proceed with its settlement of said Silicon Valley Bank in California, Santa Clara, in a manner that will ensure the total protection of all depositors, after speaking with the President and the boards of directors of the FDIC and the Federal Reserve. All depositors will be able to retrieve their money as of March 13. There won’t be any financial damage to the government as a result of the deal with Silicon Valley Bank. Moreover, the New York-based Signature Bank will close after receiving a comparable systemic risk clearance from the state chartering board. Similar to the agreement of Silicon Valley Bank, all depositors will get full compensation, and the government will not be responsible.